Some reminders about the stock market that I find useful:

It moves fast. After hitting new all-time highs on the first trading day of 2022, the S&P 500 proceeded to fall nearly 13% through early March. That 8-week long correction erased more than half of the 29% return in 2021.

Just 3 short weeks later the market has bounced nearly 11%. The S&P 500 is now down just 3% on the year.

The stock market can create or vaporize gains in hurry.

Price always changes the narrative. Remember what all the headlines were saying 3 weeks ago? They went something like this:

Stock Market Sells off on Fears the War in Ukraine Will Make Inflation Even Worse Than it Already is

Now the headlines look something like this:

Stock Market Rallies as Investors Realize They Act as an Inflation Hedge

What changed? Price, of course.

When prices were falling it was obvious inflation was a huge risk and the war was going to last for an extended period. Now that prices rising it’s obvious stocks can provide a buffer against inflation as corporations can grow their earnings and the war could come to an end.

If stocks roll over from here, it will be obvious in retrospect. If we’re back at new highs before Easter that will look obvious too.

Price movements have a funny way of changing investor perspectives about the markets.

It doesn’t always care about the headlines. Did the stock market front-run the end of the war by rising 10% in 3 weeks? I sure hope so.

But even if the stock market has predicted 9 out of the last 5 recessions and doesn’t always get everything right, it also doesn’t care about the headlines of the day.

By the time the news is in the headlines the stock market has already digested it, moved on and looking ahead for what’s next.

For better or worse, the stock market tries really hard to be forward-looking.

That can be confusing for investors that are trying to understand the market’s movements based on the news of the day.

It’s hard to beat. I assumed 2021 should have been a decent year for active managers. We finally had a situation where the overvalued hyper-growth stocks got killed while there was a renaissance for higher quality and lower valuation companies. A stock-picker’s dream, right?

Apparently, that didn’t matter.

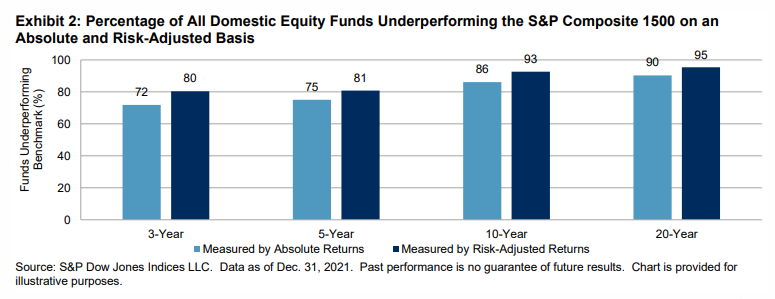

According to the latest SPIVA benchmarking report, 80% of active fund managers failed to beat the market in 2021. The long-term results are even worse:

Professional money managers are paid a lot of money to beat the stock market. Nine out of 10 fail to do so when measured over decade-long periods.

It’s tempting to try and outsmart the market.

What’s so special about an index fund?

There is nothing special about index funds other than the fact that they are low cost, tax-efficient and simply match the performance of the market.

And outthinking the stock market is not easy.

It’s not easy to pick individual stocks. Whenever I share performance numbers for the overall stock market over the past year or so, I invariably get feedback from investors who tell me the market is much worse under the surface.

“Under the surface” loosely translates to “the individual stocks I own are getting crushed.”

And it is true there are many stocks that have gotten shellacked since the early part of 2021.

Over the past year the U.S. stock market is up more than 13%. Yet in that time, more than half of all stocks in the U.S. stock market are down 20% or worse from their 52-week highs. More than one-quarter of all stocks are down 40% or worse from 52-week highs.

This year alone, 25% of all stocks in the U.S. are down 20% or worse and we’re not even done with the first quarter.

One way to look at these numbers is to complain about the biggest stocks carrying the market on its back.

Another way to look at them is to realize picking stocks is really hard. Most of the time the market is going to be much smarter than your stock picks.

No one, and I mean no one, can predict what’s going to happen in the short-term. The stock market is driven by some combination of corporate profits, trends, economic data, fund flows, expectations, greed, fear, opinions, analysis, geopolitical events and human nature.

These variables are often in conflict with one another, especially in the short run.

You could estimate all of the fundamental and economic data but whiff on the expectations built into that data. Or you could guess the news itself but misinterpret the reaction to that news. Or nail the market set-up but see something come out of left field that completely changes the game.

I don’t know any investors who survive in the markets by guessing what’s going to happen next.

I know plenty of investors who survive by creating a repeatable rules-based process that takes away the need to guess what’s going to happen next.

Survival is more important than being right when it comes to making money over the long-term.

Further Reading:

The Stock Market is Heartless

from WordPress https://ift.tt/hx5SK17

via IFTTT

No comments:

Post a Comment