Rost-9D/iStock via Getty Images

The Fed not only indicated they planned to raise rates above the neutral level in 2023 but see it staying there through 2024. It’s incredibly bearish for stocks as the Fed looks to tighten financial conditions by pushing rates above the neutral level and trying to slow the economy’s demand side.

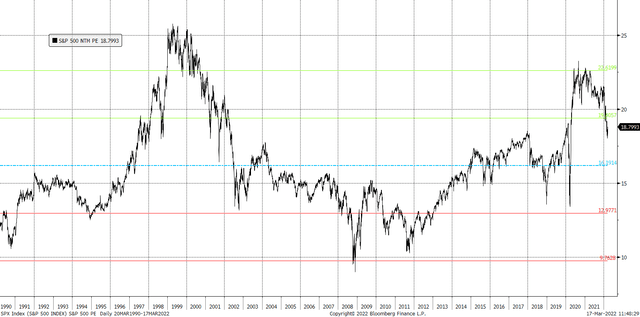

This tightening of financial conditions will compress PE multiples and weigh heavily on stock prices. Most investors seem to miss that rates are no longer low, will be rising further, and valuations in the stock market are still extremely high on a historical basis.

Bloomberg

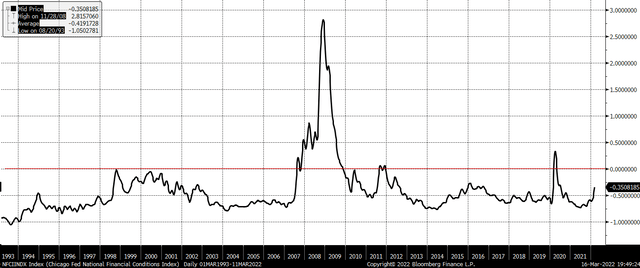

Tighter Financial Conditions

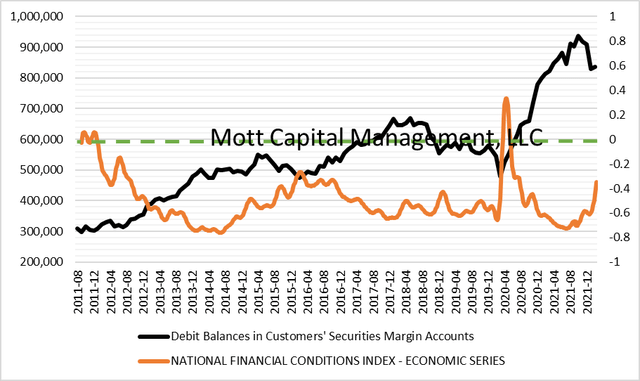

Powell told the world on Wednesday that he wants financial conditions to tighten and return to something more normal through monetary policy adjustments. This likely means financial conditions move closers to the neutral range around 0, as seen on the Chicago Fed’s Financial conditions index.

Bloomberg

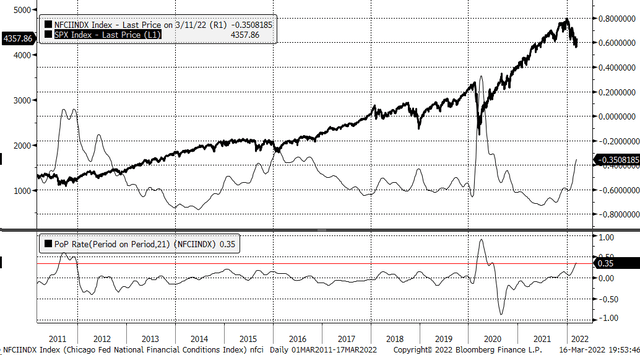

Over the past 10 years when financial conditions tightened, it has resulted in a sharp decline in equity prices. The recent decline that started in late 2021 resulted from tightening financial conditions. Over the past 10 years, the only time financial conditions tightened to these levels was in 2011, 2015/2016 and 2020, and equity prices suffered far more and longer during those times than the current pullback in the S&P 500.

If the Fed intends to tighten financial conditions further, it will be tough for the stocks markets to push on to new all-time highs.

Bloomberg

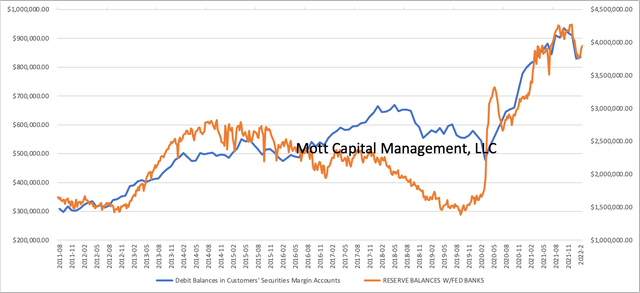

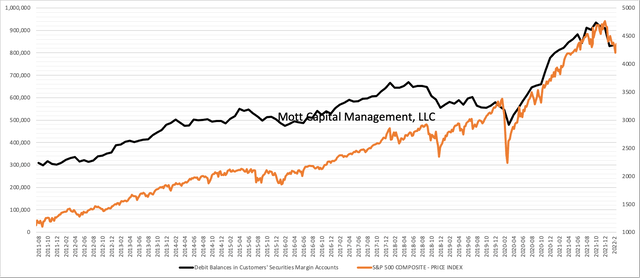

One of the ways that easy-accommodative monetary policy has made its way into the stock market is through access to leverage and margin. Margin balances as recorded by FINRA soared to a high of $935 billion as of October 2021. Now those levels stand around $835 billion. Before the pandemic and QE, these levels were at only $561 billion in January 2020. QE helps to push rates down through the Fed’s balance sheet expansion. This easing of rates made it easier and cheaper for investors to borrow on margin and transmitted into stock prices. One can very quickly see the relationship of reserve balances held by the Fed for depository institutions, along with the connection for margin levels in the stock market.

Mott Capital

It’s also effortless to see the relationship between stock prices and margin levels. So while it is clear what the Fed’s intentions are to tighten financial conditions, it seems very clear that it should have negative impacts on stock prices overall.

Mott Capital

Additionally, the margin levels are, of course, are affected directly by changes in financial conditions. Again, if the Fed intends to reduce the balance sheet and tighten financial conditions, that will dramatically impact equity valuations and prices.

Additionally, the Fed plans to shrink the balance sheet, which, based on this thesis, would suggest that margin levels should decline over time, further impacting stocks, as liquidity in the market is reduced.

Mott Capital

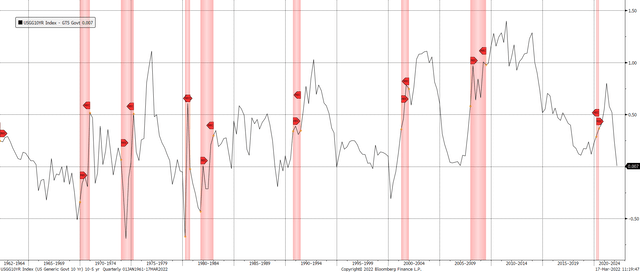

Bonds See A Recession

The bond market appears to have a different take on things and sees the current situation leading to a US recession. Whether it’s because the Fed is too late or because the Fed will cause a recession is a conversation for another day. But the spread between the ten-year and five-year is now zero. Typically when the spread between the two is at 0% or close, a US recession follows.

Bloomberg

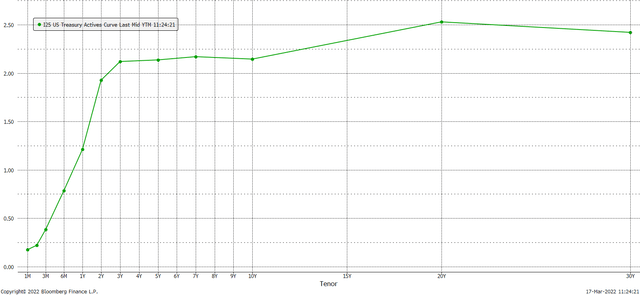

Additionally, the bond market seems to think the Fed will have a very tough time hiking rates as many times as the Fed indicated, at least to this point. The Treasury curve from the three-year to the 10-year is entirely flat. How that curve develops over the next few weeks is the question. It’s most likely to lead to further yield curve inversion, as rates on the front of the curve rise to adjust for the Fed’s ambitions.

Bloomberg

Should the Fed continue down the path they have laid out, its reverberation should be felt negatively through the equity market. The Fed is telling us they want to transmit monetary policy through tighter financial conditions. As I previously noted, tighter financial conditions are bad news for stocks, which has been the correct call, like it or not.

Investing today is more complex than ever. With stocks rising and falling on very little news while doing the opposite of what seems logical. Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, looking for opportunities.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

from WordPress https://ift.tt/o5t6L7I

via IFTTT

No comments:

Post a Comment