Berkshire Hathaway, which is led by CEO Warren Buffett, made its first purchase of Verizon Communications (VZ -1.73%) stock in the fourth quarter of 2020 and didn’t waste any time amassing a sizable position in the company. The telecom currently stands as the seventh-largest overall stock holding in the investment conglomerate’s portfolio, but its valuation has actually lost ground since that initial buy.

VZ data by YCharts

Verizon recently saw a substantial sell-off after its first-quarter results arrived with a small subscriber loss and earnings guidance that was slightly lower than anticipated, but the pullback has presented another worthwhile opportunity to invest in this great dividend stock. Let’s take a closer look at why this telecommunications leader stands out as a great play for investors seeking a combination of passive income and capital appreciation.

Verizon is backed by a great brand and adept management

Verizon’s top-rated service and brand strength have translated into high levels of customer loyalty and gross margin that are best-in-class in among mobile wireless providers. Additionally, Verizon’s management team has proven to have an astute grasp on the right way to approach the telecommunications industry.

While AT&T‘s goal of integrating a massive media empire with its telecommunications businesses once held great promise, the initiative proved to be a dud. The $85 billion acquisition of Time Warner has essentially been unwound through the unit’s subsequent spinout and merger with Discovery, resulting in the formation of Warner Bros. Discovery, and the ordeal ultimately destroyed shareholder value and caused AT&T to miss out on important opportunities.

Image source: The Motley Fool.

The fact that Verizon didn’t have billions wrapped up in acquiring and running a media business meant it was in a much better position to secure wireless spectrum band that will advance its 5G ambitions for mobile and in the home. For that reason, I will be reducing my position in AT&T in the near future and putting the proceeds into Verizon stock.

The passive-income profile here is hard to beat

After the guidance revision and post-earnings pullback, Verizon now trades at less than 10 times this year’s expected earnings and has a dividend yield of roughly 5%. The company has now increased its dividend on annual basis for 15 years running, and there’s a good chance it will continue to extend that streak in years to come.

With today’s yield, a $10,000 investment in Verizon would net you $1,500 over a three-year period. Given that the company will likely continue to increase its dividend, your passive income over the stretch should actually exceed that baseline, and the total amount generated could be even higher if you opt to roll the payments into share buybacks.

Verizon stock could see strong gains from its current level

Verizon looks cheaply valued and sports a big yield, and the business’s opportunity and the cheaply priced stock make shares attractive from a capital appreciation perspective. The demand outlook for mobile wireless and other internet communications services remains favorable over the long term, and consumers and businesses will continue to become increasingly reliant on telecom services going forward. The next big step for the company is expanding the rollout of its 5G network.

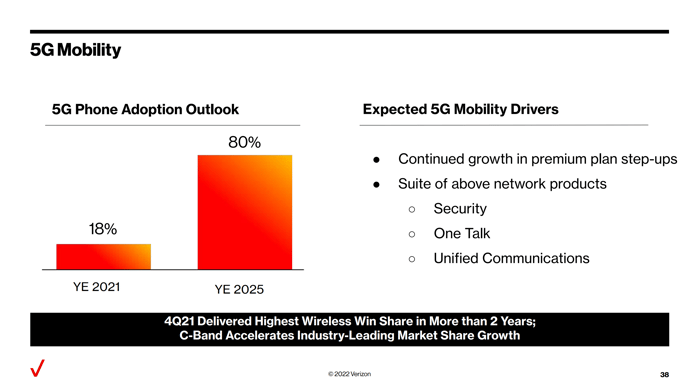

Image source: Verizon.

The company sees customers with 5G phones being 2.5 times more likely to sign up for premium unlimited data services, and increasing adoption for compatible hardware should provide the foundation for future sales and earnings growth. Verizon’s next-generation network technologies will also play a big role in paving the way for influential technology trends including augmented reality and the metaverse, and it’s recently formed a partnership with Meta Platforms to support the growth of these technologies. Spurred on by new emerging opportunities, the telecom giant sees its total addressable market expanding from $340 billion in 2021 to $460 billion in 2026.

For investors seeking stocks that offer a combination of passive-income generation and growth potential, Verizon looks like a top buy at today’s prices.

from Top Stock To Invest – My Blog https://ift.tt/HlXizS3

via IFTTT

No comments:

Post a Comment