An earnings recession is not the biggest threat facing the stock market right now. That may seem a curious assertion to make in a week in which the largest retailers are reporting disappointing earnings and retail-sector stocks are being pummeled.

In fact, contracting P/E multiples are the big culprit. To show that an earnings recession doesn’t necessarily doom the stock market, consider the S&P 500’s SPX, +0.01% quarterly return when its earnings-per-share (EPS) is falling. On average over the past century, according to an analysis conducted by Ned Davis Research, the S&P 500 has performed better when its EPS were lower than a year previously — not higher.

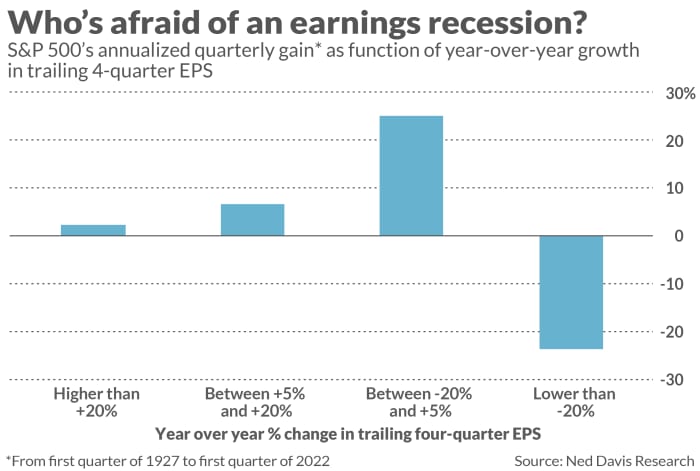

What the research firm uncovered is summarized in the chart below. Notice that the S&P 500’s best quarterly returns in the past have come when its trailing four-quarter EPS were between 20% lower and 5% higher than where they were one year prior. With the exception of quarters in which EPS were more than 20% lower than a year earlier, there’s an inverse relationship between EPS growth and the S&P 500’s performance.

Might that exception apply now? It seems most unlikely. Even with companies’ recent reduced earnings projections, Standard & Poor’s estimates that the stock market’s trailing four-quarter EPS as of June 30 will be 28% higher than the comparable total on June 30, 2021.

What causes changes in P/E multiples?

In pointing the finger at earnings multiples rather than declining earnings, I am relying on nothing more than simple arithmetic. The market’s level at any given time is equal to E times P/E, so if earnings (E) aren’t to blame, then the only other possibility is the multiple (P/E).

Over the past year, the U.S. stock market’s P/E multiple (based on trailing 12 months’ GAAP EPS) has fallen to below 20 from more than 30. Had the multiple remained constant, the S&P 500 today would be 28% higher than a year ago. In fact it is 6% lower.

What caused the P/E multiple to fall by so much? There are numerous factors, but perhaps the most important is inflation. History teaches us that P/E multiples on average are higher when inflation is lower, and vice versa.

This inverse correlation makes sense — to a point. As many have noted in recent months, a higher inflation rate means that future years’ earnings must be discounted at a greater rate when calculating their present value.

Nevertheless, this reasoning — which is widely repeated — is but half the story. The other half, as I pointed out in a column six months ago, is that nominal corporate earnings per-share tend to grow faster when inflation is higher. Over the past 150 years, this faster EPS growth has largely offset the lower P/E multiples when inflation heats up — leaving the stock market, on average, relatively unscathed during periods of higher inflation. This helps explain the results summarized in the chart.

Most investors overlook this tendency for nominal earnings to grow faster in higher-inflation environments — an error that economists refer to as “inflation illusion.” It is not just investors who are guilty of this, furthermore; company executives are, too. FactSet reports that 85% of S&P 500 companies have cited inflation in their earnings calls for the first quarter — the highest percentage since at least since 2010.

Rather than lament investors’ error, a more shrewd response would be to bet against their mistaken beliefs. One way to do that would be to place buy orders below the market price on companies with strong earnings. To the extent investors unjustly punish those companies’ shares, you will scoop up some of them at a bargain. If so, history suggests that eventually you will turn a handsome profit.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

Read: Selloff puts S&P 500 on bear market’s doorstep. If history is a guide, there’s more pain ahead.

from Stock Market News – My Blog https://ift.tt/tYwjWdP

via IFTTT

No comments:

Post a Comment