Shares rose for a second straight session on Tuesday even after Goal issued a warning about its present quarter’s earnings, which put stress on the broader retail sector.

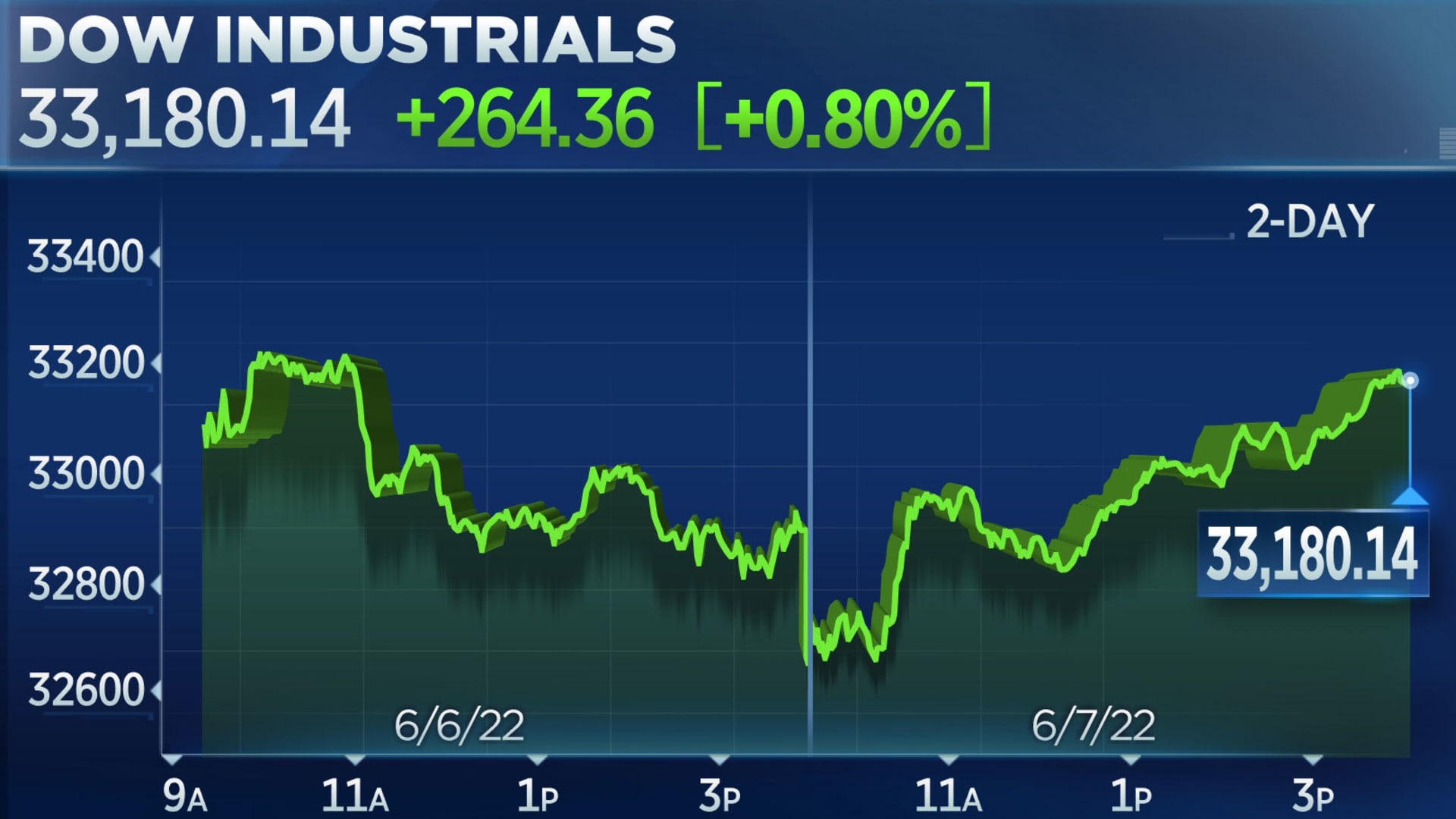

The Dow Jones Industrial Common gained 264.36 factors, or 0.8%, to shut at 33,180.14. The S&P 500 rose 0.95% to 4,160.68, and the Nasdaq Composite added 0.94% to 12,175.23. The indexes opened solidly decrease however trimmed these losses and turned constructive because the day progressed.

The beneficial properties for the averages got here despite weak spot for retail shares.

Goal shares fell 2.3% after the retailer introduced plans to work down excess inventory, although the inventory trimmed its losses because the session progressed. The corporate stated it should implement extra markdowns to merchandise and cancel some orders. Goal additionally lowered its working margins steering for the quarter. Walmart shares adopted Goal decrease, sliding 1.2%. Amazon fell 1.4%.

Main retailers have delivered blended outcomes and outlooks in current weeks, including to inventory market volatility as traders attempt to decide if the bulletins sign the beginning of a possible recession or a fast change in shopper spending that caught some corporations off guard on the stock aspect.

“I hear shifting spending, not stopping spending. So if you consider the previous few years, you’ve gotten had a transfer towards items spending over providers spending. That’s now unwinding as we push farther from the influence that Covid had on us,” Brent Schutte from Northwestern Mutual Wealth Administration stated on CNBC’s “Squawk on the Street.”

Vitality was one among high performing sectors on Tuesday as oil futures hovered close to $120 per barrel. Exxon jumped greater than 4% following an upgrade from Evercore ISI, placing the inventory above $100 per share for the primary time since 2014. Phillips 66 and Chevron gained about 3.7% and 1.9%, respectively.

Shares of Apple rose 1.7%, serving to to spice up the tech sector. In company deal information, Kohl’s jumped 9.5% after the retailer stated it was in unique negotiations with Franchise Group a few potential takeover.

Elsewhere, J.M. Smucker rose 5.7% following a better-than-expected quarterly report for the meals firm.

Equities might have been helped by developments within the bond market on Tuesday, because the benchmark 10-year Treasury yield retreated back below 3%.

Shares are actually nicely off their lows from mid-Might, however traders are nonetheless ready to see if the current bounce in shares is a bear market rally or has the market reached a backside from this yr’s sell-off.

“For six consecutive weeks for the reason that starting of April, traders continued so as to add new shorts and, therefore, lengthen their bearish bias available on the market. Whereas this bearish momentum did fade on the finish of Might, the previous week has proven no indicators of any bullish circulation momentum to help a extra sustained rally from right here,” Citi strategist Chris Montagu stated in a word to shoppers.

Issues concerning the macro economic system could also be limiting the current beneficial properties for shares. The Atlanta Federal Reserve’s GDPNow tracker confirmed a growth rate of just 0.9% for the second quarter on Tuesday, down from 1.3% final week. The World Financial institution minimize its global growth forecast to 2.9%.

The U.S. shopper, nevertheless, seems to nonetheless be a brilliant spot for traders, even with the blended outcomes for retailers.

“We’re nonetheless taking a look at respectable progress for this yr, that is the primary take away. The buyer’s nonetheless in respectable form,” stated Ed Moya, senior market analyst at Oanda.

Might’s shopper worth index studying, which is due out Friday, is the primary financial indicator that traders are expecting this week. If the studying is cooler than April’s numbers, as anticipated, some might interpret it as an indication that inflation has peaked.

-CNBC’s Michael Bloom contributed to this report.

Lea la cobertura del mercado de hoy en español aquí.

Correction: A earlier model of this text mistakenly included Novavax in a bunch of shares that rose Tuesday.

from Stock Market News – My Blog https://ift.tt/OAdCm3w

via IFTTT

No comments:

Post a Comment