Shares fell on Wednesday as traders monitored indicators of a possible financial slowdown and stored an eye fixed on the bond market.

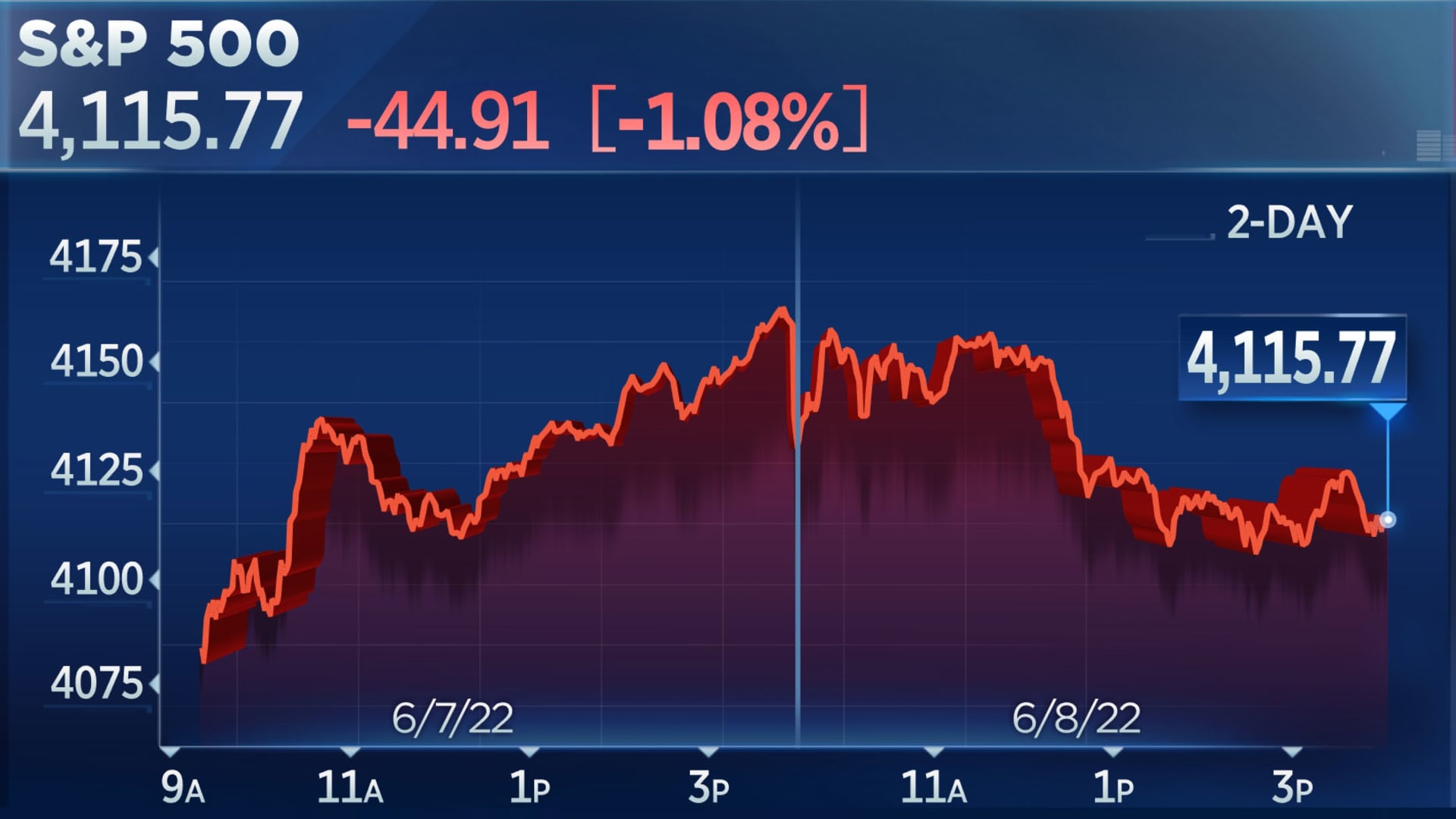

The Dow Jones Industrial Common shed 269.24 factors, or 0.81%, to shut at 32,910.90. The S&P 500 slid 1.08% to complete at 4,115.77, whereas Nasdaq Composite dropped 0.73% to 12,086.27.

The strikes got here as traders weighed updates from main firms and indicators that financial progress could also be slowing.

The U.S.-traded shares of Credit score Suisse fell 1% after the bank issued a profit warning for the second quarter, citing tighter financial coverage and the conflict in Ukraine. Intel dropped greater than 5% after administration warned of weakening demand for semiconductors at an trade convention.

In the meantime, the Atlanta Federal Reserve’s GDPNow tracker exhibits a growth rate of just 0.9% for the second quarter, down from 1.3% final week. Mortgage demand hit its lowest level in 22 years final week, in line with the Mortgage Bankers Affiliation.

Deutsche Financial institution chief U.S. economist Matthew Luzzetti, who beforehand referred to as for a recession by the end of 2023, mentioned in a word to purchasers on Wednesday that the percentages for a recession are prone to rise within the coming months.

“Our important conclusion is that forward-looking recession possibilities are prone to look way more sinister later this yr as monetary situations tighten,” Luzzetti wrote.

Because the Fed continues to tighten financial situations, the issues about financial progress and company earnings may have a much bigger affect on shares, Allianz chief financial advisor Mohamed El-Erian mentioned on CNBC’s “Squawk Box.”

“The markets have been taking this information a lot better than they’d have in any other case, but when I have been totally invested proper now, I might take some chips off the desk. I might watch for extra worth to be created,” El-Erian mentioned.

Motion within the bond market might have damage investor sentiment on Wednesday, because the 10-year Treasury yield jumped again above 3%. The worth of oil additionally rose, with U.S. benchmark West Texas Intermediate crude pushing nicely above $120 per barrel.

Power was a shiny spot for the market, because the sector closed at its highest degree since August 2014. Chinese language tech shares helped increase the Nasdaq, with the U.S.-traded shares of JD.com and Pinduoduo rising about 7.7% and 9.7%, respectively.

Elsewhere, shares of Robinhood fell 3.9% after Securities and Trade Fee Chair Gary Gensler detailed potential rule changes around trade execution, resembling presumably requiring retail orders to be routed into auctions. Moderna rose practically 2.2% after its modified Covid-19 booster shot confirmed a stronger response to new variants.

On the earnings entrance, Campbell Soup moved increased by about 1.5% after a stronger-than-expected quarterly report.

Traders are wanting towards Friday’s shopper worth index studying for Might. Many consider the print will probably be essential for the trail of Fed coverage and whether or not the central financial institution will maintain elevating charges in half-point increments.

“We consider fairness markets would probably rally at any trace of a pause within the anticipated rate-hike cycle. Optimistic shopper information may additionally assist relieve some progress fears however, in some circumstances, may additionally additional issues that the Fed must get extra aggressive to chill demand,” Wells Fargo strategist Scott Wren mentioned in a word to purchasers.

“Inventory market rallies at this level will probably see headwinds and never significant observe via till there are clear indicators the Fed is succeeding in controlling inflation,” Wren added.

The inventory market has had a roller-coaster yr because the Fed’s aggressive price hikes stoked recession fears. The S&P 500 is off about 14% from its all-time excessive reached in January. The fairness benchmark briefly dipped into bear market territory on an intraday foundation final month. The tech-heavy Nasdaq, in the meantime, is down roughly 25% from its document excessive.

from Stock Market News – My Blog https://ift.tt/UJD2Qyl

via IFTTT

No comments:

Post a Comment