Who doesn’t love a great growth stock? Consider what a $10,000 investment made in Tesla 10 years ago would be worth today: a cool $1.62 million.

It’s this potential for explosive returns that leads many to include growth stocks in a balanced portfolio. Because you never know which one might turn out to be the next Tesla.

So let’s look at a few stocks with serious potential: Perhaps not the potential to match Tesla’s insane 16,000% return over 10 years but still stocks worth owning nonetheless.

1. Microsoft

When it comes to growth stocks worth owning and holding forever, Microsoft (MSFT -5.47%) is near the top of my list. The software giant has diversified in recent years, building a thriving cloud services business, expanding its gaming division, and buying business-networking site LinkedIn.

The company has an astounding 46% return on equity, operating margins of 42%, and nearly $200 billion in revenue over the last 12 months. Those impressive figures more than justify its price-to-earnings (P/E) ratio of 27.4, which is a good deal higher than the S&P 500 average of 20.5.

Microsoft has long earned a premium from the market — its five-year average P/E is over 35. Smart investors might use the recent market swoon as an opportunity to load up on one of the world’s premier companies — before its valuation bounces higher.

2. Spotify

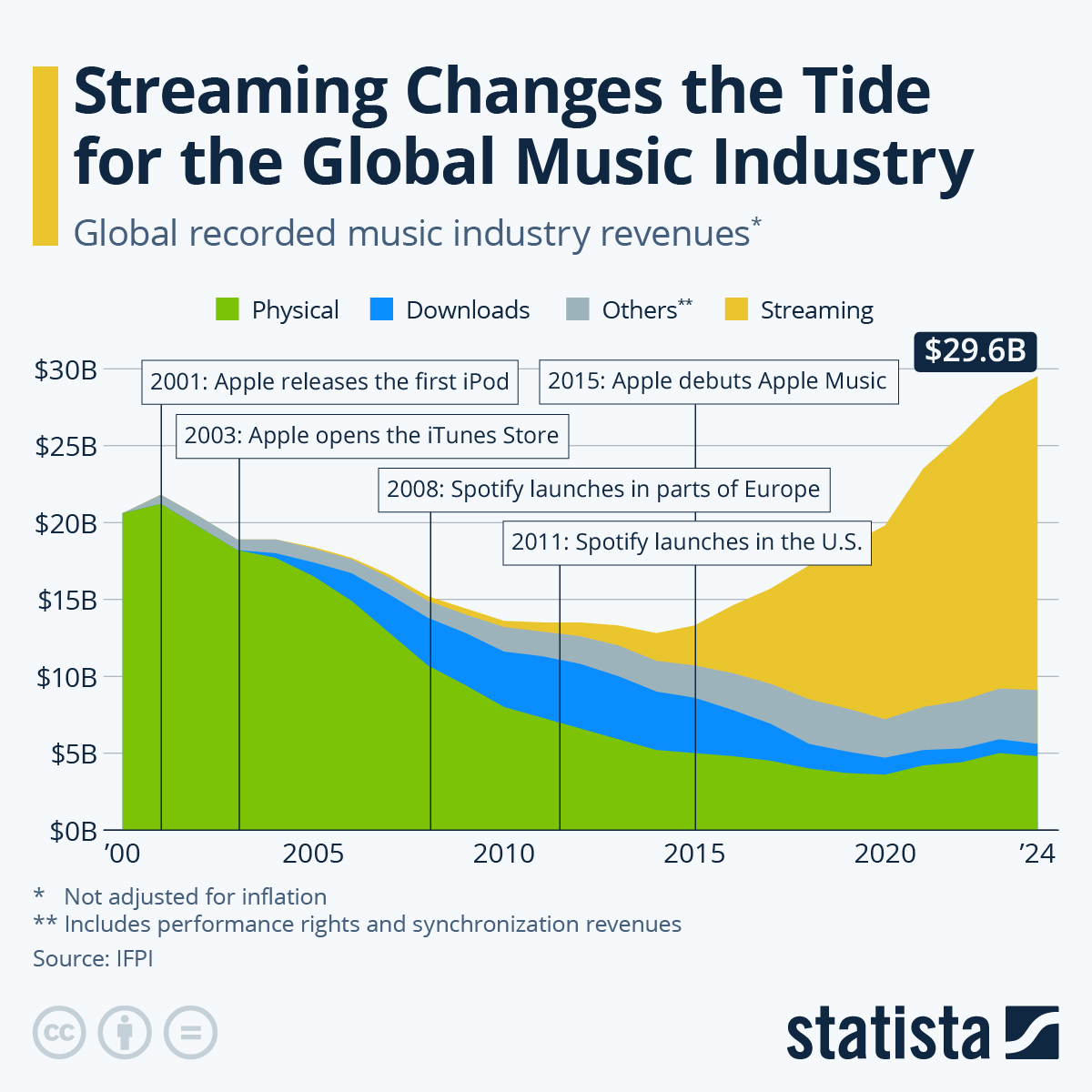

After years of decline, music industry revenue has surged to its highest level in more than 20 years. The reason? Music streaming companies like Spotify (SPOT -8.43%).

While physical and digital music sales have continued to wane, audio streaming has exploded over the last seven years and now accounts for over $15 billion of music industry revenue. Moreover, Spotify isn’t satisfied with just delivering great music to its users. The company has invested in podcasts and audiobooks, landing exclusive deals with celebrities as varied as Joe Rogan and Meghan Markle.

Operationally, the company is firing on all cylinders. In its most recent quarterly report, Spotify announced a 19% year-over-year increase in daily average users (DAUs) to 433 million and a 14% jump in paid subscribers to 188 million. The company is expanding its international user base, and it specifically called out blistering growth among Gen Z users in Latin America. Just as video streaming disrupted traditional TV and movies, streaming has done the same to audio. Smart investors should take note and load up on Spotify shares now.

3. Roblox

My third recommendation is Roblox (RBLX -6.25%). As I’ve noted before, owning Roblox is one way for investors to participate in the growth of Web3. As the internet continues to evolve, more and more individuals will start to own virtual assets: digital currencies, non-fungible tokens, and many other forms of property.

Roblox, as the operator of an online metaverse-style gaming network, has a first-mover advantage when it comes to Web3. It has some 58.5 million DAUs. In July alone, its users spent more than 4.7 billion hours exploring its platform. This size and scale, along with the brand loyalty and network effect that results from such a large pool of users, means Roblox has a leg up on other companies that want to “own” the metaverse. Yes, I’m looking at you, Meta Platforms.

While Meta Platforms is spending billions of dollars to develop its own version of the metaverse, Roblox has already captured the hearts and minds of millions of users, many of them under the age of 18. And while this year has seen Roblox stock tumble as it came up against incredibly difficult year-over-year comparisons to its lockdown-fueled 2021, the company continues to steadily grow its user base.

In time, those users (and their billions of hours spent on the platform) will be monetized. Investors who are willing to ride out this admittedly volatile name should be rewarded for their patience.

4. Airbnb

The fourth stock to buy and hold forever is Airbnb (ABNB -2.74%). If there’s one thing everyone can agree on, it’s this: After the last two years, it seems everyone has needed a vacation this year. And as the world largely rolled back pandemic restrictions and travel picked up, Airbnb was there to provide a place for eager tourists to stay.

Image Source: Getty Images.

But the company is so much more than just a play on reopening economies. CEO Brian Chesky made waves when he announced in May of this year that, “The office, as we know it, is over.” Chesky seems to be right on the money. Airbnb has reported that close to half of its bookings are for stays of seven days or more, and 19% are for stays of 28 days or more.

Airbnb is capitalizing on the new work-from-home reality. And it’s bringing a sense of whimsy to travel by offering exotic accommodations like castles, windmills, caves, and treehouses.

The analyst community is convinced. Wall Street expects Airbnb to record $8.3 billion in revenue this year, a jump of 38% from 2021. For the following year, it expects revenue to surpass $9.5 billion.

So for investors looking to add growth to their portfolio, Airbnb is a stock worth adding to their wish list.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Airbnb, Inc., Roblox Corporation, Spotify Technology, and Tesla. The Motley Fool has positions in and recommends Airbnb, Inc., Meta Platforms, Inc., Microsoft, Roblox Corporation, Spotify Technology, and Tesla. The Motley Fool has a disclosure policy.

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Top Stock To Invest – My Blog https://ift.tt/zFcYAhq

via IFTTT

No comments:

Post a Comment